Key Budget variables

President Buhari recently presented 2020 budget proposal of N10.33 trillion to lawmakers at the National Assembly (NASS). Below are key highlights of the proposal

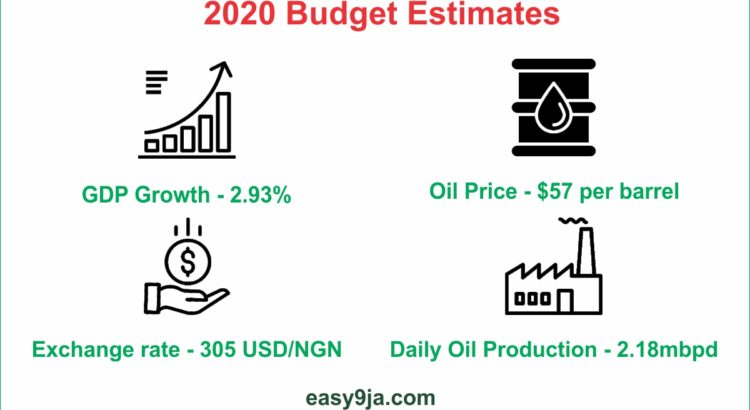

- The budget set an oil price benchmark of $57 per barrel and a daily oil production estimate of 2.18 million barrel per day.

- The exchange rate is estimated at N305 per US dollar in 2020

- GDP growth of 2.93% is projected which would be driven by non-oil output

Objectives of the budget

The core objectives of the budget are:

- Promoting fiscal equity by mitigating instances of regressive taxation

- Reforming domestic tax laws to align with global best practices

- Introducing tax incentives for investments in infrastructure and capital markets

- Supporting Micro, Small and Medium-sized businesses in line with our Ease of Doing Business Reforms

- Raising Revenues for Government

VAT Ammendments

Estimate of Internally Generated Revenue factors in increase of the VAT rate from 5% to 7.5%, limitation of VAT registration to companies with turnover per annum of N25million and above.

The amendment to VAT legislation from the Finance Bill 2019, also expands the VAT exempt items to include:

- Brown and white bread

- Cereals including maize, rice, wheat, millet, barley and sorghum

- Fish of all kinds

- Flour and starch meals

- Fruits, nuts, pulses and vegetables of various kinds

- Roots such as yam, cocoyam, sweet and Irish potatoes

- Meat and poultry products including eggs

- Milk

- Salt and herbs of various kinds

- Natural water and table water

Revenue Estimate

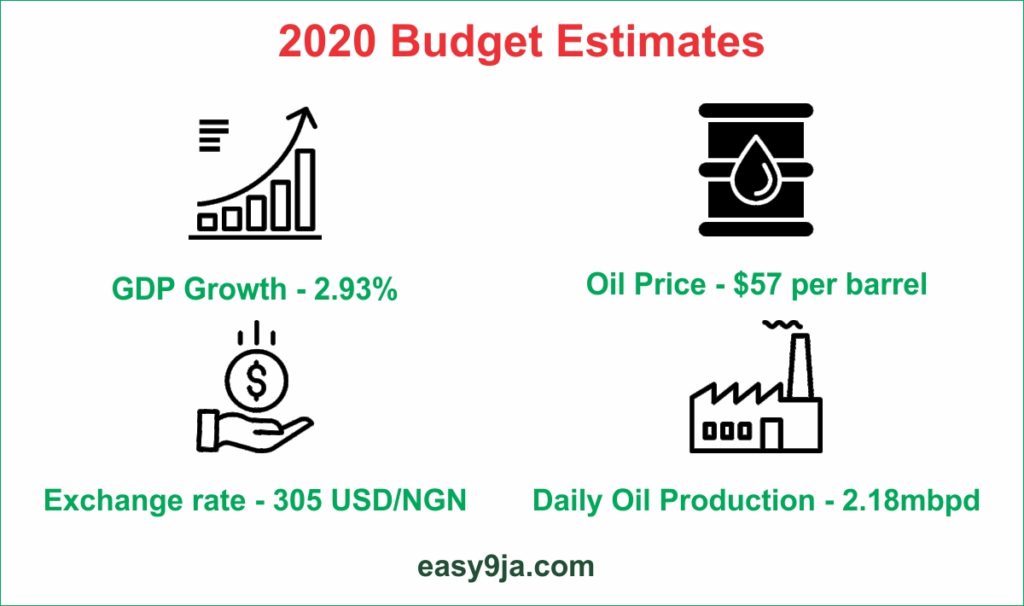

Total revenue estimate of the Federal Government in 2020 is N8.1555 trillion. Comprising of Oil revenue N2.64 trillion, non-oil tax revenues of N1.81 trillion and other revenues of N3.7 trillion.

Expenditure Estimate

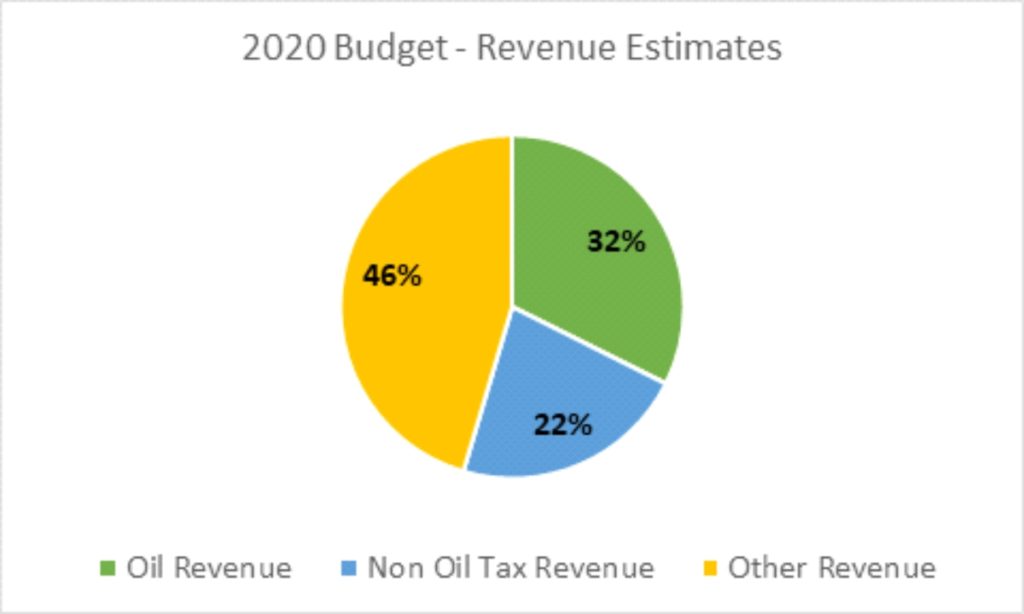

Aggregate expenditure of N10.33 trillion is proposed. The expenditure estimate includes statutory transfer of N556.7 billion, non-debt recurrent expenditure of N4.88 trillion and N2.14 trillion of capital expenditure. Debt service is estimated at N2.45 trillion, and provision for Sinking Fund to retire maturing bonds issued to local contractors is N296 billion.

Statutory Transfers

Statutory transfers in the 2020 budget is estimated to be expended as follows:

- National Assembly – N125 billion

- Judiciary – N110 billion

- North East Development Commission – N37.83 billion

- Basic Health Care Provision Fund – N44.5 billion

- Universal Basic Education Commission – N111.79 billion

- Niger Delta Development Commission – N80.88 billion

Non-debt recurrent expenditure includes N3.6 trillion for personnel and pension costs, an increase of N620.28 billion over 2019

Overhead costs are projected at N426.6 billion in 2020

Capital Projects

An aggregate sum of N2.46 trillion (inclusive of N318.06 billion in statutory transfers) is proposed for capital projects in 2020. Key capital allocations in the budget include:

- Works and Housing – N262 billion

- Power – N127 billion

- Transportation – N123 billion

- Universal Basic Education Commission – N112 billion

- Defence – N100 billion

- Zonal Intervention Projects – N100 billion

- Agriculture and Rural Development – N83 billion

- Water Resources – N82 billion

- Niger Delta Development Commission – N81 billion

- Education – N48 billion

- Health – N46 billion

- Industry, Trade and Investment – N40 billion

- North East Development Commission – N38 billion

- Interior – N35 billion

- Social Investment Programmes – N30 billion

- Federal Capital Territory – N28 billion

- Niger Delta Affairs Ministry – N24 billion

Debt Service

The estimate for debt service is N2.45 trillion, 71% of which would be used in servicing domestic debt. The sum of N296 billion is provided for as Sinking fund to retire maturing bonds to local contractors.

A sum of N65 billion is provided to cater for the Presidential Amnesty Programme.