An index is an indicator or measure of something. In finance an index refers to a statistical measure of change in a security market. In the case of financial markets, stock and bond market index funds consist of a portfolio of securities representing a particular market or a portion of it.

An index investment program is funded by shareholders that trades in diversified holdings and is professionally managed. Mutual Funds have become very popular in recent times. Investors who are part of a company-sponsored retirement plan or an individual investment portfolio have to choose which funds to select, even without understanding the overall value of their investment.

Main Index funds in the world

When putting together mutual funds and exchange-traded funds (ETFs), fund sponsors attempt to create portfolios mirroring the components of a certain index. This allows an investor to buy a security likely to rise and fall in sync with the stock market as a whole or with a segment of the market.

Top Index funds in the world

S&P 500

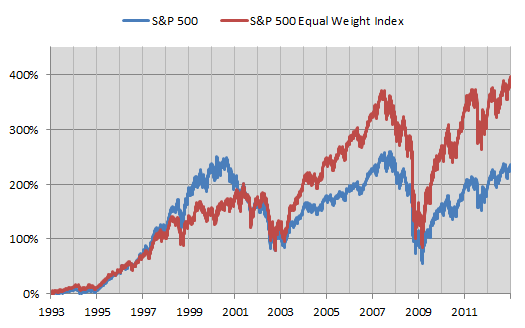

The S&P 500 is an American stock market index based on the market capitalization of 500 large companies having stocks listed on the New York Stock Exchange (NYSE). The S&P 500 index components and their weightings are determined by S&P Dow Jones Indices. It differs from other U.S. stock market indices, such as the Dow Jones Industrial Average or the Nasdaq Composite index.

It is a popular stock index in the world that shows performance of the American stock exchange. It is considered as one of the best representations of the U.S. stock market and a main indicator of the U.S. economy. The National Bureau of Economic Research has classified common stocks as a leading indicator of business cycles.

Dow 30

The Dow Jones Industrial Average (DJIA), the Dow 30 or simply the Dow is a stock market index created by Wall Street Journal editor and Dow Jones. The DJIA is currently owned by S&P Dow Jones Indices and is majorly owned by S&P Global. The averages are named after Dow and one of his business associates, statistician Edward Jones. It is an index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market.

Nasdaq

The Nasdaq Stock Market is an American stock exchange. It is the second-largest exchange in the world by market capitalization, behind only the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic (formerly known as OMX) and Nasdaq Baltic stock market network and several other US stock and options exchanges.

Dax

The DAX is a blue chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard’s 30 largest German companies in terms of order book volume and market capitalization. It is the equivalent of the FT 30 and the Dow Jones Industrial Average, and because of its small selection it does not necessarily represent the vitality of the economy as whole.

Nikkei 225

Nikkei is short for Japan’s Nikkei 225 Stock Average, the leading and most-respected index of Japanese stocks. It is a price-weighted index comprised of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange. The Nikkei is equivalent to the Dow Jones Industrial Average Index in the United States.

Importance of Indices

Mutual funds pool money from individuals and organizations to invest in stocks, bonds, and other assets in different industry sectors and regions of the world. You can buy whole or fractional fund units directly from fund companies or through your broker. The price of each mutual fund unit reflects the market prices of the fund holdings, adjusted for management fees and expenses.

Mutual funds are a cost-effective way to diversify an investment portfolio across different asset categories and industry sectors. Instead of buying and monitoring potentially dozens of stocks, an investor could buy a few mutual funds to achieve broad diversification at a fraction of the cost. For example, equity funds offer an indirect way to invest in dozens of companies in different industry sectors, while balanced funds offer exposure to both stocks and bonds. Further diversification is possible within each asset category.

Professional money management expertise at a reasonable cost is another important attribute of mutual funds. Fund managers typically have postgraduate finance degrees, and several years of stock analysis and investment management experience. Mutual fund companies use a combination of in-house research staff and the services of external research firms to determine the composition of fund portfolios.

Mutual funds have leveled the playing field by bringing the financial markets closer to small investors. For about the price of an average stock, an investor can participate in the capital gains and dividend distributions of potentially dozens of companies. You do not have to spend a sizable amount of your savings to invest in each one of these companies separately. Mutual fund companies are able to spread research, commissions, and related expenses over a larger asset base, which reduces the cost for individual fund investors. You can reduce the costs even further by holding index mutual funds, which track major market and industry indexes. These funds have low management fees and expenses because they do not have the research and trading costs of actively managed funds.